ATTENTION: income investors

Why Wall Street's Elite Are Quietly Moving Into Gold

The smart money is making an unexpected shift. Michael Burry, who famously predicted the 2008 housing crash, has recently sold his tech holdings to buy gold. He's joined by legendary investor Stanley Druckenmiller, whose hedge fund never saw a down year since 1981, who's also exiting tech giants like Alphabet and Amazon in favor of strategic gold positions.

sponsor

I've discovered a way to get exposure to MORE than an ounce of gold... for under $20.

It's not bullion. It's not ETFs. And it's certainly not crypto.

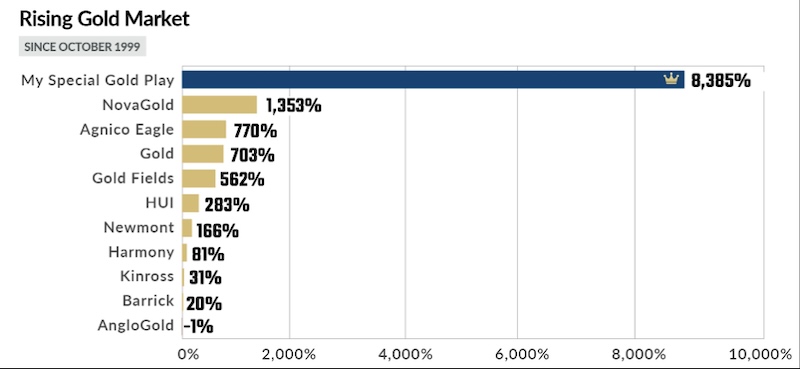

Rather, it's a unique gold play that has outperformed physical gold by 10X over 25 years...

Their timing is notable. Central banks are buying gold at the fastest pace in history, pushing prices above $2,500 per ounce. Yet market indicators suggest this could be just the beginning.

What's particularly interesting is how sophisticated investors are approaching this opportunity. Rather than buying physical gold or standard mining stocks, they're targeting a lesser-known segment of the gold market that historically delivers significantly higher returns during bull markets. When gold rises modestly, these specialized investments have consistently delivered 5 to 10 times the returns of the metal itself.

The opportunity lies in a remarkable market disconnect. Several overlooked companies in the sector currently hold gold reserves valued far above their market capitalization, with one notable example trading below $20 per share despite controlling substantial gold assets.

Three factors make the current timing critical:

Federal Reserve policy shifts historically precede major gold bull markets

Record government debt levels pressure the dollar

Growing industrial demand adds new pressure to precious metals markets

Goldman Sachs projects continued bullish momentum in gold prices, while JP Morgan calls this "a golden era for gold." With investment funds more bullish on gold than they've been in four years, the signals are becoming clear - smart money is positioning ahead of what could be a historic move

For retail investors, the key isn't whether to participate, but how to structure that participation for optimal returns. History shows that vehicle selection often matters more than the underlying trend itself.

[Editor's Note: To learn more about how sophisticated investors are positioning for the next major move in gold, click here.]

did the article make sense? if so...

You Need To Watch This Next

The smart money is piling into gold and gold stocks.

Michael Burry, Stanley Druckenmiller, David Einhorn... they're all making massive bets on the yellow metal.

But here's what they're not telling you...

There's a backdoor gold play that could deliver 10 TIMES bigger gains than physical gold.

In fact, this single investment has outperformed gold by 10-to-1 over the past 25 years... and FAR outperformed most gold stocks.

The secret behind this outperformance is that it gives you exposure to MORE than an ounce of gold for less than $20!

That's why I've put together a special presentation on this opportunity... you can access it right here.

Don't wait - this could be the gold story of the decade.

TRENDING STORIES

Washington's reckless spending is ruining the economy, destroying the dollar and robbing your retirement savings.

But you don't have to sit by and take it...Thanks to a little-known "IRS loophole," you can shift savings into the safety of gold without penalties or taxes taken.If you absolutely REFUSE to let greedy politicians ruin your retirement...Get your

FREE 2024 Gold Guide and discover how to secure your savings and avoid a retirement shortfall while you still can.

There is nothing the Federal Reserve can do to stop what's coming next for U.S. stocks. As you've seen yourself with all this recent volatility...The wheels are falling off the United States stock market.

If you think a simple rate cut can "solve" this...

When the Government Releases Certain Data, Either Good or Bad...

You Can Target Up to +383% Overnight (See the Proof!)

New Trade Goes LIVE THIS TUESDAY at 2 pm

Disclaimer for MyInvestorNewsAndReports.com

MyInvestorNewsAndReports.com, a brand under Market Insiders Media dba, operates under the parent company Sandpiper Marketing Group, LLC. Please be advised that MyInvestorNewsAndReports.com is not registered as an investment adviser or broker-dealer with the United States Securities and Exchange Commission or any state regulatory agency. We rely on the "publisher's exclusion" from the definition of investment adviser as set forth in Section 202(a)(11) of the Investment Advisers Act of 1940, as amended, as well as corresponding state securities laws. Consequently, MyInvestorNewsAndReports.com does not offer or provide personalized investment advice.

The information we provide is based on our opinions, statistical and financial data, and independent research of public information. Our materials are intended for informational purposes only, and no mention of a specific security in any of our content constitutes a recommendation to buy, sell, or hold that or any other security. Any information deemed to be investment opinion is impersonal and not tailored to the investment needs of any individual.

Please be aware that MyInvestorNewsAndReports.com does not promise, guarantee, or imply that any information provided through our websites, newsletters, reports, or printed material will result in profit or loss. We strongly encourage you to seek personal advice from your professional investment, tax, or legal advisors and to conduct your own due diligence and independent investigations before acting on any information we publish or making any investment decision. Only you and your professional advisors can determine the level of risk appropriate for you. Penny stocks, in particular, are inherently speculative investments, and you should be prepared to lose your entire investment.

Employees, owners, and/or writers of MyInvestorNewsAndReports.com may own positions in the equities, options, and/or securities mentioned in our content. However, no associated employees will intentionally engage in any transaction that directly or indirectly competes with the interests of our subscribers. MyInvestorNewsAndReports.com may be compensated for publishing information about companies referred to in our reports, newsletters, and websites, and we provide full disclosure of such compensation.

Furthermore, please note that any content marked as "Sponsor" may be paid for and is not endorsed or warranted by our staff or company. Specifically, we are compensated five dollars per click by i2i LLC for clicking on the ad for AUST Mining Company. The content in our emails is for educational or entertainment use and is not a substitute for professional advice or an offer to buy or sell any securities. Neither the publisher nor the editors are registered investment advisors (RIA’s) and do not provide personalized counseling. Be sure to conduct your own careful research and consult with your advisors before taking any action based on our content. By opening our emails or clicking any links contained therein, you are reconfirming your opt-in status, which is part of your free subscription.